Have you ever thought about adding an ADU (Accessory Dwelling Unit) to your property to boost your income, but froze when you saw the potential costs? Many homeowners in California face the same dilemma:

- “How much does it really cost?”

- “Is it better to build an ADU or buy a prefab ADU?”

- “Can I afford a 2-bedroom ADU in San Jose or Los Angeles?”

The truth is, building an ADU can be one of the smartest investments for your property, but the process can feel overwhelming. From permits to construction to landscaping, every step comes with costs that can add up quickly.

In this guide, we provide a complete cost breakdown for building an ADU, covering:

- Costs per square foot

- City-specific estimates

- Comparison between custom-built and prefab ADUs

- Tips to save money without sacrificing quality

We’ll also show how modern tools like construction proposal software and construction project management firms can simplify the process and prevent expensive mistakes.

How Much Does It Cost to Build an ADU?

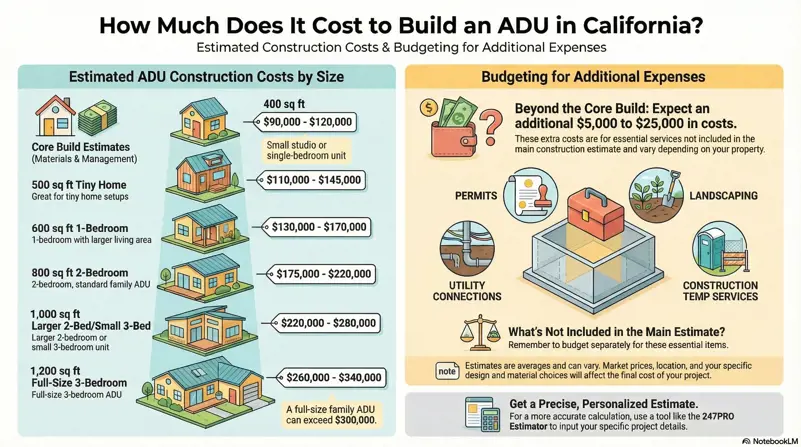

The cost of building an ADU in California depends on multiple factors, including size, location, design, and materials. Here's an estimated cost table:

| ADU Size | Estimated Cost | Notes |

| 400 sq ft | $90,000 - $120,000 | Small studio or single-bedroom unit |

| 500 sq ft | $110,000 - $145,000 | Great for tiny home setups |

| 600 sq ft | $130,000 - $170,000 | 1-bedroom with larger living area |

| 800 sq ft | $175,000 - $220,000 | 2-bedroom, standard family ADU |

| 1,000 sq ft | $220,000 - $280,000 | Larger 2-bedroom or small 3-bedroom unit |

| 1,200 sq ft | $260,000 - $340,000 | Full-size 3-bedroom ADU |

Tip: These costs include construction, materials, and project management. Additional costs such as landscaping prices, construction temp services, permits, and utility connections are separate and can range from $5,000 to $25,000 depending on your property.

Note: These cost estimates reflect average market prices and may vary depending on your location, design choices, and materials. For a more precise and personalized estimate, you can use the 247PRO construction proposal software tool to calculate costs based on your specific project details.

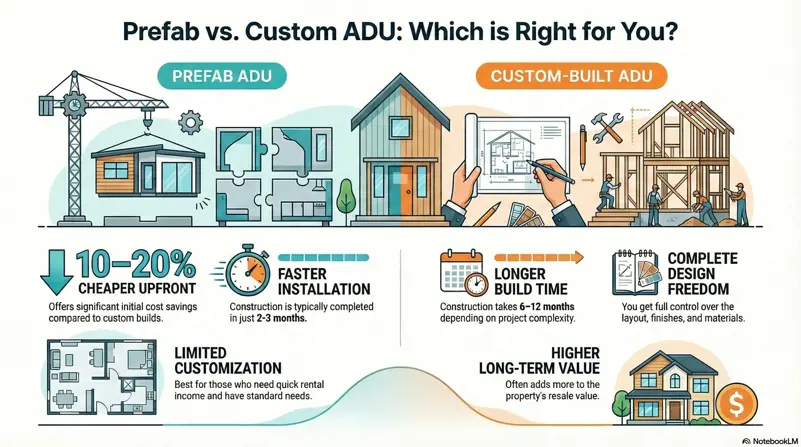

Is It Cheaper to Build an ADU or Buy a Prefab?

One of the most common questions homeowners ask is whether a prefab ADU can save money. Let’s break it down:

Prefab ADU

- Installation Time: 2–3 months, faster than traditional construction

- Cost Savings: 10–20% cheaper upfront than custom builds

- Customization: Limited design and material choices

- Best For: Quick rental income or small properties

Custom-built ADU

- Flexibility: Full control over layout, finishes, and materials

- Long-term Value: Higher initial cost, but often adds more resale value

- Time: 6–12 months, depending on size and complexity

- Best For: Unique property needs or high-end finishes

What is the Cheapest Way to Build an ADU in California?

Building an ADU doesn’t have to break the bank. Here are some tips:

- Choose a prefab ADU: especially in high-cost areas like San Jose or the Bay Area

- Keep the size smaller:400–500 sq ft units are more affordable and faster to build

- Optimize your construction plan: tools like construction proposal software help identify cost-saving opportunities

- Use local, cost-effective materials: shipping and import costs can add up

- Outsource specific tasks: landscaping or temporary construction services can save you money if handled by specialized teams

Even with a smaller budget, a well-planned ADU can provide rental income or additional living space without sacrificing quality.

Cost to Build an ADU Per Square Foot

Calculating the cost per square foot is one of the most effective ways to estimate your ADU budget. Prices can vary based on design, materials, and labor, so knowing the range for different unit sizes helps you plan more accurately. The table below shows estimated costs per square foot and total costs for ADUs of various sizes in California.

| Square Footage | Cost per Sq Ft | Total Cost |

| 400 sq ft | $225 - $300 | $90,000 - $120,000 |

| 500 sq ft | $220 - $290 | $110,000 - $145,000 |

| 600 sq ft | $215 - $285 | $130,000 - $170,000 |

| 800 sq ft | $220 - $275 | $175,000 - $220,000 |

| 1,000 sq ft | $220 - $280 | $220,000 - $280,000 |

| 1,200 sq ft | $215 - $285 | $260,000 - $340,000 |

Pro tip: Using two-way MMS for team communication can prevent costly errors during construction and keep your project on schedule.

Cost to Build an ADU in California by City

When it comes to building an ADU, costs can vary significantly depending on the city due to differences in labor rates, permit fees, and local regulations. Understanding these regional variations is crucial before planning your project. The table below provides average costs for a 2-bedroom ADU in major California cities and highlights important factors to consider in each location.

| City | Average Cost (2-Bedroom ADU) | Notes |

| San Jose | $250,000 - $320,000 | Prefab ADU options available |

| Los Angeles | $200,000 - $300,000 | Labor costs are higher than in other regions |

| San Francisco | $220,000 - $330,000 | Permits are expensive; plan ahead |

| Sacramento | $160,000 - $230,000 | More affordable labor and materials |

Costs include professional project management and accurate estimates using construction project management firms. City-specific codes, zoning, and permits can affect the final price, so always check local regulations.

Note: These cost estimates reflect average market prices and may vary depending on your location, design choices, and materials. For a more precise and personalized estimate, you can use the 247PRO Estimator tool to calculate costs based on your specific project details.

Costs per square foot can vary based on:

- Type of construction (prefab vs custom)

- Quality of materials

- Labor rates

- Additional services like construction temp services

Note: These cost estimates reflect average market prices and may vary depending on your location, design choices, and materials. For a more precise and personalized estimate, you can use the 247PRO Estimator tool to calculate costs based on your specific project details.

Additional Costs to Consider

While construction is the main expense, other costs include:

- Cost to build a shed: Separate storage options for tools and equipment

- Landscaping prices: Patio, garden, or driveway adjustments

- Construction temp services: Hiring temporary labor can optimize project duration

- Cost to build a tiny home: A budget-friendly ADU alternative

Proper planning ensures you don’t face unexpected costs during construction.

How to Maximize Value from Your ADU

- Rent it out: Turn your ADU into a steady source of rental income

- Home office: Save on renting commercial office space

- Guest house: Increase property value and provide comfort for visitors

Using construction proposal software and professional construction project management firms ensures your project stays on time and budget while maximizing ROI.

Conclusion

Building an ADU in California is a significant and smart investment that can not only increase your property value but also provide an additional income stream. However, without careful planning and a full understanding of costs and project steps, this investment can quickly become complex and expensive.

By leveraging modern tools such as construction proposal software and working with professional construction project management firms, you can streamline the building process, control costs, and avoid costly mistakes.

Additionally, by choosing the right strategy, such as determining the optimal size and type of ADU, exploring prefab options, and optimizing materials and labor, you can achieve the best results with minimal time and cost.

Ultimately, an ADU not only provides extra living or guest space but also serves as a smart long-term investment for your property. With proper planning, any homeowner can build a successful and cost-effective ADU that both adds value and generates sustainable income.

FAQ:

1. How long does it typically take to get permits for an ADU in California?

Permit timelines vary by city, but on average, it can take 2–6 months. Larger or more complex projects may take longer, so planning ahead is essential.

2. Can I finance an ADU construction through a home equity loan or other funding options?

Yes, many homeowners use home equity loans, lines of credit, or construction loans. Some local programs may also offer incentives or low-interest options.

3. Are there any tax incentives or credits for building an ADU in California?

Certain California cities and counties provide property tax exemptions or incentives for ADU construction. Check with local authorities for the most up-to-date programs.

4. Do ADUs require additional insurance, and how much does it cost?

ADUs typically require homeowner’s insurance adjustments or separate policies. Costs vary depending on size and coverage, but generally range from $300–$800 per year.

5. What are the maintenance costs of an ADU after construction?

Maintenance costs include utilities, repairs, landscaping, and cleaning. On average, expect $1,500–$3,500 per year, depending on size and usage.

6. Can I rent out an ADU short-term (like Airbnb), or is it restricted?

Short-term rentals are regulated differently in each city. Some cities allow Airbnb rentals, while others require special permits or restrict short-term leasing.

7. How does building an ADU affect property taxes and resale value?

Adding an ADU generally increases property value, which may raise property taxes. However, rental income potential can offset additional costs and make it a strong long-term investment.