Steel is a vital component of modern construction, particularly in the form of new, cost-effective, and environmentally friendly pre-engineered metal buildings (PEMBs). In comparison to other choices, steel is very strong, durable, and faster to build. The cost of using steel, however, can change constantly due to different variables that can directly impact the overall cost of the project.

What Influences Metal Prices?

The pricing architecture of metals, specifically structural steel, is no longer dictated by simple supply-demand curves. As we navigate 2026, a fusion of geopolitical shifts and technological transitions has redefined these drivers:

Global Supply and Demand (The Shift to Infrastructure): While the classic balance remains, 2026 is seeing a surge in demand driven by "Smart City" projects and renewable energy infrastructure. The construction boom in the PEMB sector has made supply tighter for high-grade structural steel.

Energy Costs (The Volatility of Decarbonization): It’s not just about oil prices anymore. In 2026, the cost of "Carbon Credits" and the transition to electricity-based smelting (EAF) are the primary energy-related drivers. High energy costs now directly correlate with the "Green Premium" on steel.

Raw Material Dynamics (Scrap vs. Ore): The 2026 market shows a massive pivot toward Scrap Metal as industries push for circular economies. The availability of high-quality scrap now influences the price of new steel just as much as traditional iron ore extraction.

Trade Policies and Digital Tariffs: Beyond traditional trade wars, 2026 has introduced "Carbon Border Adjustment Mechanisms" (CBAM). These are essentially "Green Tariffs" that impact the cost of imported steel based on its carbon footprint, directly affecting project estimates in the U.S.

Economic Resilience: Instead of a general "thriving economy," we are now looking at Interest Rate Stability. In 2026, as rates stabilize, the backlog of delayed projects is hitting the market all at once, creating a unique "demand spike" that keeps prices buoyant.

If you are considering building a steel structure, understanding the factors that influence steel prices can help you have a more realistic estimate of the project’s cost.

Mainly two primary factors can influence steel price, and each is divided into other subfactors; these two factors are as follows”

- Economic and Global Factors

- Project-related Attributes

Understanding these two main elements is crucial in having an accurate estimation of the project.

Economic and global factors affecting steel prices

The price of steel is deeply connected to several complex factors at both local and global scales, and most of the time, they are beyond our control.

- Supply and Demand: This is the most basic principle in economics. During certain seasons, the construction industry experiences a global boom, and demand for steel increases, which can subsequently lead to a rise in the process. On the other hand, an economic downturn can significantly reduce construction activity and lead to lower prices.

- Raw Material Costs: Steel production depends on iron ore, coal, and scrap metal. Any sudden change in global raw material cost, extraction, and transportation can directly impact the cost of producing steel. For example, in the recent 2024 Suez Canal blockage, ships had to reroute around the Cape of Good Hope, which increased delivery times and fuel costs, ultimately leading to higher steel costs in some periods.

- Energy Costs: It is crystal clear that producing steel is a highly energy-intensive process. The price of oil, gas, and electricity can affect the operational costs of steel production.

- Exchange Rates: For countries that import or export steel or related materials, the exchange rate can alter the final rate.

These factors can significantly impact the cost of steel worldwide, and in many cases, they are beyond our control; however, by understanding and considering them, you can prevent many unexpected financial issues.

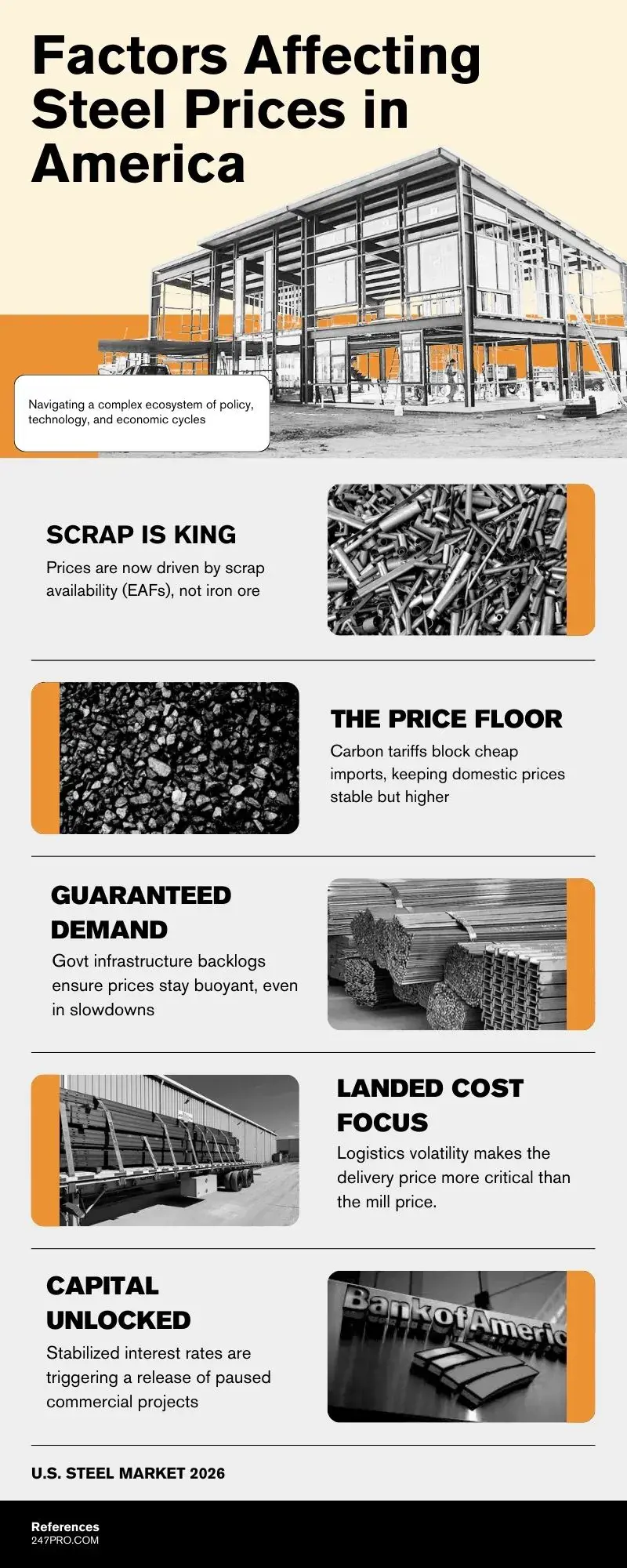

Factors Affecting Steel Prices in America

Steel pricing within the United States operates within a unique ecosystem where domestic structural shifts often outweigh global noise. As we analyze the 2026 landscape, the interplay between policy, production technology, and economic cycles has reached a new level of complexity:

- The Dominance of EAF and Scrap Dynamics: Unlike many global markets, the U.S. steel industry in 2026 is heavily anchored by Electric Arc Furnace (EAF) production. Because these mills rely on scrap metal rather than iron ore, domestic steel prices are now more sensitive to "Scrap Availability" than ever before. Any volatility in the domestic recycling supply chain directly translates to immediate price adjustments at the mill level.

- Geopolitics as a Price Floor: Trade policies and tariffs have evolved beyond simple protectionism. By 2026, environmental trade barriers (such as carbon-intensity tariffs) have joined traditional anti-dumping regulations. These policies act as a "price floor" for U.S. steel, ensuring that while domestic prices remain stable, they are often insulated from the lower-cost, high-carbon alternatives found internationally.

- Infrastructure-Driven Demand Supercycles: The demand is no longer just "cyclical",it is structural. Government-backed infrastructure programs targeting 2026-2030 milestones have created a sustained backlog for structural steel. This "guaranteed demand" means that even during minor economic slowdowns, steel prices for commercial and industrial grades tend to remain buoyant.

- Logistics: The "Last Mile" Pricing Factor: In 2026, the price of steel isn't just what the mill charges; it’s what it costs to deliver. With the ongoing transformation of the U.S. trucking industry and fluctuations in rail efficiency, logistics costs have become a volatile component of the final quote. For contractors, the "landed cost" of steel at the job site is now a more critical metric than the per-ton price at the source.

- The Interest Rate & Construction Lag: The 2026 market is finally reacting to the interest rate shifts of 2024-2025. As rates have stabilized, a "release" of previously paused commercial projects is hitting the market, creating a unique demand spike. This lag effect demonstrates that steel consumption in America is often more tied to the cost of capital than the raw availability of the metal itself.

Project-related Attributes

These are typically the specific characteristics of your project that can significantly impact the cost of steel and the overall project cost. The good news is that you have some control over these factors and can manage the financial aspects of the project accordingly.

- Size of the Building: A larger building will require a greater volume of steel. Even a small percentage change can result in a significant increase or decrease in total steel costs.

- Type of Steel: Different types of steel can react to market fluctuations in varying ways. For example, common structural steel, such as A36, endures fewer changes compared to specialized alloys like stainless steel or high-strength low-alloy (HSLA) steel.

- Design and Complexity: A simple, pre-engineered metal building uses less steel and fewer connections; on the other hand, a customized or complex design demands specialized tools, materials, and more steel.

- Labor Costs: Labor costs are a significant portion of your project budget. Complex projects often require specialized expertise, which can result in higher labor expenses.

For complex projects, coordinating material deliveries and labor efficiently is crucial. Using construction work order software can help streamline tasks, track progress, and control costs.

What Is the Price of US Steel Today?

In the volatile steel market of 2026, the current steel market price is a moving target. For contractors and project managers, relying on outdated quotes can lead to significant budget overruns. As of the current cycle, steel prices in the U.S. are influenced by a stabilized post-2025 economy, yet they remain sensitive to local logistics and energy surcharges.

Understanding the price today requires looking at three distinct layers:

- Benchmark Commodities: Prices for Hot-Rolled Coil (HRC),the industry bellwether, are currently reflecting the new equilibrium between domestic supply and the high cost of "Green Steel" production.

- The "Landed" Reality: In 2026, the gap between the "mill price" and the "job-site price" has widened. Regional supply-demand imbalances in high-growth areas like the Southeast often add a 5-8% premium over national averages.

- Alloy Surcharges: For those using high-strength alloys or specialized structural steel, surcharges for molybdenum and nickel are more volatile than the base iron price itself, requiring a line-item approach to budgeting.

Pro Tip: Don't just look at the price per ton. Look at the Lead Time. In 2026, a "lower price" with a 12-week lead time is often more expensive than a "premium price" with 2-week delivery when factoring in labor standby costs.

Structural Steel Prices

Visualizing the data is the only way to spot the noise versus the trend. When analyzing price charts this year, we are seeing a departure from traditional seasonal cycles.

What the 2026 Data Tells Us:

- Price Plateau: After the fluctuations of 2024-2025, 2026 shows a "stair-step" pattern;brief periods of stability followed by sharp adjustments based on federal interest rate announcements.

- The "Green Steel" Divergence: For the first time, charts are showing a clear price separation between standard structural steel and low-carbon alternatives, with the latter commanding a 10-15% premium.

Inventory-to-Demand Ratio: Current charts indicate that service centers are keeping leaner inventories, meaning any sudden spike in construction activity leads to faster price hikes than in previous decades.

The importance of timing steel purchases in large projects

In large construction projects, proper timing of steel purchases and delivery is a key element that can significantly impact the final cost. Poor timing can lead to considerable savings or losses. All the factors we mentioned above should be taken into consideration for purchasing steel. For example:

- Market Monitoring: If you manage to purchase steel during low-demand periods, such as construction off-seasons, you can spend less money on steel; however, during peak demand, you are forced to pay more.

- Lead Time Planning: Timely delivery is very important in saving money, as it usually takes weeks or months. Ordering time early will require storage, which adds to your cost. However, late delivery can cause delays in the construction process and consequently increase costs.

- Project Phasing:For large or multiphase projects, you can buy in bulk or enter into agreements with steel producers to fix a price for a specific period. Coordinating this with a detailed material schedule in construction helps prevent shortages and avoids idle labor costs.

Using a steel building cost calculator can be helpful for estimating the steel cost at different times. Considering these factors can significantly help you financially.

Strategies for managing price fluctuation risks

To minimize the impact of steel price changes on the final cost, you can adopt several strategies: Adopting these strategies can help mitigate unexpected expenses, including hidden and ancillary costs in steel building construction.

- Fixed-Price Contracts: As mentioned previously, contractors and suppliers can sometimes agree on a fixed price for a specific period. This can significantly decrease the risk of high prices and provide certainty for budgeting purposes.

- Material Escalation Clauses: these clauses are included in the contracts to safeguard against unpredictable cost increases and allow the contractor to adjust the final cost if the prices of raw materials go higher than a specific threshold (e.g., 5% or 10%)

- Diversified Sourcing: If you have a single fixed source for buying steel, even minor issues with tariffs or disruptions can cause significant problems with your project. Therefore, purchase steel from multiple suppliers and even different regions to reduce dependency on a single source.

- Just-in-Time (JIT) Delivery: By using this method, you can have your purchased supplies delivered precisely when they are needed. This method will minimize the cost of storage, as well as any damage or theft to the materials.

- Market Forecasting and Analysis Services: There are some specialized analytical services that can analyze and predict the future price trend in the industry. Getting help from these services can help in making more informed decisions.

Adopting these strategies can help mitigate unexpected expenses, including hidden and ancillary costs in steel building construction.

Factors Affecting Steel Prices in 2026

Forecasting steel prices for 2026 is less about crystal-ball gazing and more about strategic scenario planning. While precise figures are elusive, identifying the critical inflection points can provide contractors with a crucial edge in planning and budgeting for the immediate future. The dynamics in 2026 are shifting toward environmental policy and digital transformation:

- Global Production Capacity (China’s Green Pivot): The capacity story of 2026 is dominated by China's aggressive decarbonization goals. As Beijing enforces stricter capacity cuts to meet environmental targets, the global supply balance is tightening. U.S. contractors should expect less import competition and a greater reliance on North American supply chains.

- Raw Material & The Circular Economy: The shift in 2026 is profound: the availability of high-grade scrap metal is becoming a more volatile factor than iron ore futures. Environmental regulations are pushing the U.S. toward electric arc furnace (EAF) production, making efficient scrap recovery a key determinant of 2026 pricing stability.

- Energy Prices & Carbon Costs: Energy costs in 2026 include a new variable: the price of carbon permits. As global and domestic markets adopt carbon pricing mechanisms, the true cost of energy-intensive steel production is rising, creating a permanent "Green Premium" on certain product lines.

- Trade Policies (CBAM & Tariffs): Expect "Carbon Border Adjustment Mechanisms" (CBAMs) to be fully implemented in key markets by 2026. These tariffs penalize high-carbon steel imports, fundamentally reshaping global trade flows and ensuring U.S. domestic steel operates within a protected (and higher-priced) ecosystem.

- Economic Growth vs. The Cost of Capital: While post-pandemic construction demand remains robust, the primary headwind in 2026 is the Federal Reserve’s interest rate policy. High interest rates curb large-scale, long-duration projects, balancing the demand pressure and creating a cautious environment for price spikes.

Tech & Predictive Analytics: The adoption of AI and predictive analytics in 2026 is changing purchasing. Contractors are now leveraging platforms to hedge their steel purchases, smoothing out the peaks and troughs of market volatility.

Are Steel Prices Going Up or Down in 2026?

Steel price movements in 2026 will depend on a mix of global trends, domestic policies, and industry-specific dynamics. While no forecast can guarantee exact numbers, analyzing key indicators can provide insights into whether prices are likely to rise or fall.

Factors suggesting potential price increases:

- Rising Construction and Infrastructure Demand: Large-scale projects and government-funded infrastructure initiatives in the U.S. and globally can increase steel consumption.

- Higher Raw Material Costs: Any increase in iron ore, coal, or scrap prices can push steel prices upward.

- Tighter Trade Policies: Tariffs or import restrictions may limit foreign steel supply, driving domestic prices higher.

- Energy Price Volatility: Spikes in electricity, oil, or natural gas costs for production can raise finished steel prices.

Factors suggesting potential price decreases:

- Expanded Production Capacity: Increased output from major steel producers can boost supply and stabilize or lower prices.

- Technological Efficiency: Advancements in steel production or alternative materials could reduce costs.

- Economic Slowdowns: Reduced construction and manufacturing activity may lower demand, putting downward pressure on prices.

Bottom line: While steel prices may fluctuate in 2026, monitoring these key indicators, maintaining flexible sourcing strategies, and using predictive tools can help businesses prepare for potential price changes and minimize financial risks.

Forecasting future steel price trends

Predicting future steel prices is a challenging task due to various visible and invisible factors, some of which are beyond our control. However, paying attention to the key factors that shape steel prices can help you gain a clear picture of the market and, to some extent, predict its direction. For this purpose, you need to pay attention to the following items:

- Global Production Capacity

- Energy Prices

- Global Economic Growth

- Raw Material Costs

- Tariffs and Trade Policies

- Real Estate Boom

For an accurate prediction, it is recommended to consult with construction project management firms and utilize various tools. By predicting future steel prices, you can minimize any upcoming financial issues and establish an accurate budget.

FAQ

1. How can I determine the best time to purchase steel to reduce project costs?

Monitor market trends and seasonal demand fluctuations. Purchasing during off-peak construction periods or negotiating fixed-price contracts with suppliers can save money. Lead time planning is also crucial to avoid storage costs or project delays.

2. What is the real impact of using Green Steel on final costs and ROI?

Green Steel typically carries a 10–15% premium due to carbon-efficient production. However, it can enhance sustainability credentials, comply with environmental regulations, and potentially qualify for tax incentives, improving long-term ROI.

3. How can I estimate steel costs for large or multi-phase projects?

Use bulk purchasing agreements, fixed-price contracts, or staggered procurement strategies. Tracking supplier price forecasts and hedging with predictive analytics platforms helps mitigate sudden market spikes.

4. Do energy and carbon price changes matter for small contractors?

Yes. Even minor fluctuations in electricity, gas, or carbon permit costs can influence the “Green Premium” and delivery charges. Awareness of these factors helps in accurate budgeting.

5. What financial and practical factors should I consider when choosing steel types (A36, HSLA, Stainless)?

Standard steel like A36 is more stable in price, while specialized alloys are sensitive to raw material costs. Consider the project’s structural requirements, long-term maintenance, and susceptibility to market volatility.

6. How can I reduce the risk of delays in steel delivery and associated costs?

Implement Just-in-Time (JIT) delivery, coordinate lead times with project phases, and maintain flexible sourcing from multiple suppliers. Early communication with mills can prevent costly downtime.

7. Are there tools or resources to track and forecast steel prices?

Yes. Market forecasting services, predictive analytics platforms, and industry reports (e.g., Hot-Rolled Coil prices, scrap metal trends) provide real-time data to help plan purchases and manage budget risks.